Prior to the craft resistance, there existed a simpler Republic. The majority of beer and it’s underlying transaction data rolled up through two rival empires: Blue (MillerCoors) & Red (Bud) wholesalers. While the two were constantly at odds on the streets through pricing, marketing spend, and television commercials, enough space existed for both to grow and thrive. Despite their battles for light supremacy, the two sides shared the same operational challenges, including getting paid timely by retailers and without deploying Stormtroopers. When a solution emerged for all parties to automate and reconcile their collection process, an all new source of beer data would fall into the hands of a higher power and unite the two sides.

Origin Story

When I started my role in Internal Audit at Reyes Holdings in early 2009, my first site visit would be to their local MillerCoors distributor. In addition to testing the Balance Sheet for accuracy, we did do a soup to nuts review of the operation examining processes from the standpoint of efficiency and ensuring the accuracy of data rolling up into the company’s financial statements. Along the way, we’d test various risks including compliance with laws and regulations and in Illinois there’s an important concept of being a Cash State. Essentially it’s illegal here, and plenty of other states, for a distributor to offer payment terms to a retailer on their beer purchase. Payment must be tendered at the time of delivery, in part to avoid financial favoritism being given in exchange for placements.

Of all the tricky alcohol laws to navigate, being forced to be paid upon delivery doesn’t sound so bad from the standpoint of the wholesaler. The requirement leads to a boost to cash flows and eliminates the need to chase down A/R (Accounts Receivables). Challenges however include the fact that deliveries are made at all times of the morning, afternoon, and evening. Orders change last minute due to out-of-stocks, late additions, and other factors. The right person with check writing capability isn’t always present or available to issue and sign for payment at the time of delivery.

Fintech

The term Fintech comes from a combination of the words “financial” and “technology,” referring to software that sets out to make financial services and processes easier, faster and more secure for businesses. This complex industry has become a major buzz word in Silicon Valley and venture capital, most recently attached to cryptocurrency as its gained continued momentum.

In the late 1990s when eBay rose to prominence, a solution was needed to more securely and instantly pay for goods without cash, check, or money order. Paypal stepped in as the early winner in the space, gaining mainstream consumer adoption before being acquired by eBay in 2002 and later spun off in 2015. Similarly, beer wholesalers needed a solution of their own to simplify getting paid and a company, wisely named after the eventual industry term Fintech, was created.

After decades of growth, Fintech now helps over 5,100 alcohol distributors manage and automate their payment collection, cash flow, and accounts receivable from 225,000 retailers through 950,000 weekly invoices. As a result, they’re sitting on a mountain of invoice data, representing 1/3 of all retailer alcohol purchases, including the underlying retailer’s location & type, brands purchased, format, size, quantity, and price of each line item.

Power in Numbers

Fintech’s cumulative data serves an especially important role for their clients and in 2014, the company entered a partnership with the National Beer Wholesalers Association (NBWA) to provide pivotal new insights into the on-going health and trends in the beer industry. The NBWA’s mission includes providing leadership, programs, and services which enhance the independent beer and beverage distribution industry, with this partnered content being a prime benefit for its members. Due to being far from complete, the data must be treated as experimental, educational, and complementary to other sources but can still paint insightful pictures.

To learn more, I reached out to Lester Jones, NBWA’s Chief Economist, and he was kind enough to share a treasure chest of data and charts from a recent presentation that help exemplify how Fintech data can be used to answer questions like:

How healthy are beer sales from the standpoint of the retailer? Are they bringing in more beer overall compared to last year? How do sales in $ compare to actual volume? Are increases in dollar sales just due to price increases when in fact volume is actually down? How does this change week-by-week over the course of the last year?

How is the off-premise (stores) doing compared to the on-premise (bars, restaurants, etc.)? To what extent are one or both improving over the prior year? Is the overall pie growing or shrinking?

How are specific companies and brands performing, including competitors, and how does this benchmark against my own business? Which brands are gaining strength in the market and which are declining? Are my own trends reflective of national trends? Are these trends in the on-premise, off-premise, or both?

To what extent are cans continuing to gain share over bottles in the off-premise? In the on-premise, is draft beer coming back over packaged beer compared to COVID trends? Are cans eating into bottles in the on-premise as well? To what extent?

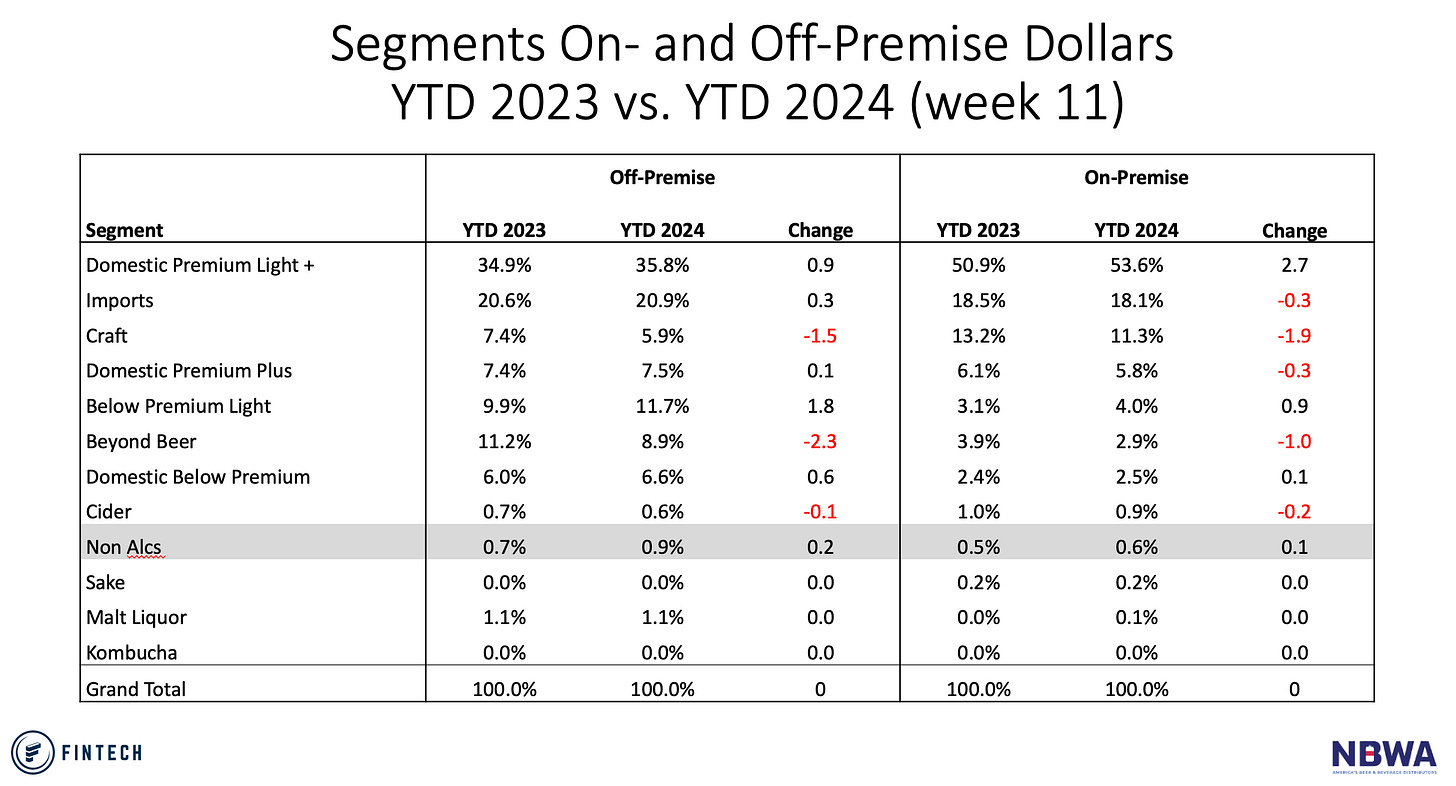

What categories are gaining or losing momentum year-over-year and to what extent? How do those trends compare in the on-premise vs. off? Is my portfolio balanced to combat any of the negative trends I’m facing with opportunities with an upward trajectory?

Same chart, but comparing the first 11 weeks of 2024 to the same period in 2023:

While still small, non-alcs are continuing to gain share. Which brands are leading that market and to what extent is it fluctuating?

Target Acquired

The rise of Fintech began with a solution to a problem for wholesalers. The subsequent data wound up unlocking a force that helps find common ground and unite the middle tier. But to continue to expand its market power in the Beer Data Wars, Fintech would set its sights on the supplier tier next, acquiring the most dangerous tool large to medium sized craft breweries possessed.

Coming up next…

![distributor-optimized.mp4 [video-to-gif output image] distributor-optimized.mp4 [video-to-gif output image]](https://substackcdn.com/image/fetch/$s_!R9k_!,w_1456,c_limit,f_auto,q_auto:good,fl_lossy/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0304088b-4e64-4d09-8a1b-b3065ff29696_454x454.gif)