Inside Hop Water Data 📈💦

I get excited when peers from other breweries needle me for believing in Hop Water . Not because I need the extra motivation, but more so that I prefer this category maintain its staunch critics and avoid everybody FOMO-ing in. When literally everyone is chasing the same thing, that’s when I get nervous. Hop Water is still a micro trend, barely representing a bread crumb of IPA’s market share. Showing big growth numbers isn’t terribly difficult at this young stage, but it’s still worth noting how much more Hop Water is being sold year-over-year. I got a look at the last four weeks and last 52 weeks of NIQ data ending 12/2/23 and came up with the following data points worth sharing.

1. Follow the Leader 🫡

The Hop Water category is +143% growth in the last 52 weeks and +72% in the last 4 weeks, per NIQ. Those percentages are likely to keep shrinking as the base gets larger, but more big players getting involved could change that theory. I know of a few about to hop (sorry) aboard.

Lagunitas deserves a ton of credit for introducing the beer industry to the concept back in 2018. A quick name change the following year led to the Hoppy Refresher brand that we know today. Late 2022 brought on a significant liquid update, packaging refresh, cans in addition to bottles, and a fruit variety pack fueling 70% growth over the last 52 weeks, and representing over 41% of the entire category fives years into its tenure.

2. State of Hop Water

California is well understood as the birthplace of the American Pale Ale and IPA. Perhaps no coincidence, the three largest Hop Water brands all hail from the state of California, not completely on the production side, but in brand origin and company headquarters. Following Lagunitas are LA-based Hop WTR at #2 and Sierra Nevada at #3.

By including Hoplark at #4 ,who was recently acquired and folded into Brooklyn Brewing, these top four largest producers cumulatively make up 91% of Hop Water sales in the last four weeks. The remaining 9% consists of only about 27 brands. The number is being challenged each four week period as more regional breweries slowly enter the space and await Dry January features.

3. Sparkle Hops & Daypack

Known among diehard fans for their english barleywine Mother of All Storms, the Oregon coast’s Pelican Brewery has been quietly making the 5th best selling Hop Water over the 52 weeks, up +64% in the last 4 weeks, though in the most recent 4 week period, Sparkle Hops was edged out by emerging behemoth in the NA space, Athletic Brewing. Their Daypack brand which has been around for a few years via Direct-to-Consumer, announced last month that they now have national distribution. While Athletic’s is almost 6X smaller than the 4th largest brand, that may just be due to the timing of their wider roll-out into stores.

4. Friends of Beer Crunchers

Austin Beerworks launched their own new namesake Hop Water brand which I’ve had and enjoyed thoroughly, as did their neighbors St. Elmo Brewing. The cumulative sales of both brands puts these two Austin brands in the Top 10 in Sales, which is not bad for a breweries who stays very close to their Texas home.

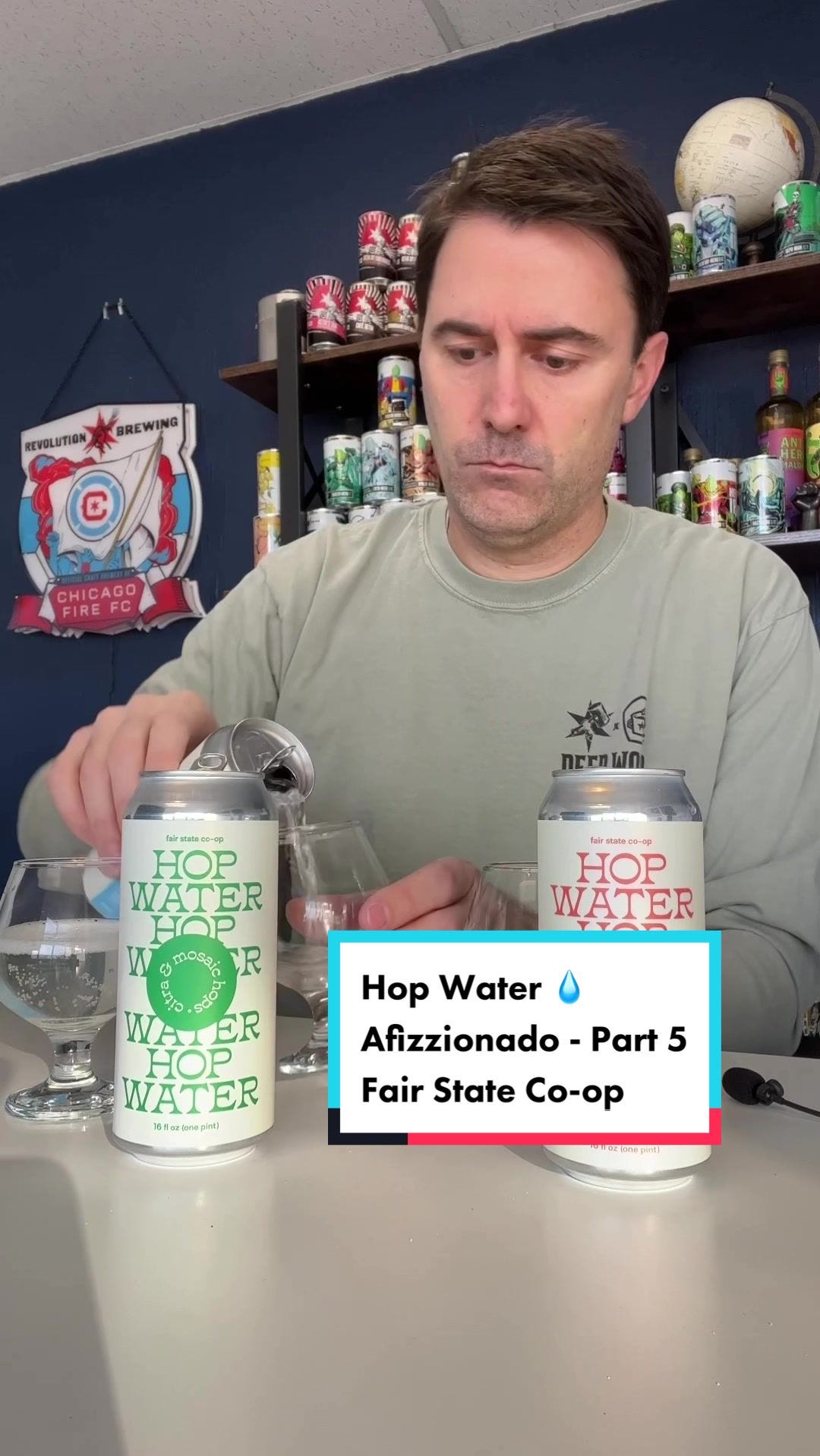

Besides our own, probably my favorite Hop Water that I’ve tried belongs to Fair State out of Minneapolis who launched with 3 unique hop combinations back in 2022. They’ve since climbed up to #12 in the country over the last 52 weeks with distribution in only a couple states.

At Revolution Brewing, our freshly launched Super Zero has been out for a little over 2 months now and it’s #11 Nationally in the last 4 weeks while only being sold in IL, WI, and Northern IN. I say this not to gloat because it’s a very small number compared to our top selling beers. Instead, it demonstrate just how small Hop Water is at this point, but perhaps how much opportunity still awaits.

5. Is the Price Right?

Depends on who you ask…but most fans looking for the solution that Hop Water provides are not bothered by the price. In looking at the NIQ data, the average price of the Top 10 is $8.51/unit, which includes a mix of 4-packs & 6-packs, and even the Lagunitas 12-pack unfairly pulling it up a bit. For consumers in the mindset of pre-inflationary craft beer prices, this is going to feel too high for a sparkling water. For those who have adjusted to $11.99 being the new $9.99 in their beer purchase index, it’s not bad at all and for those looking to cut back on drinking, they’re bothered by the price at all.

Hop Water is NOT having a gold rush moment in my opinion and there’s still a lot of education that still needs to take place and sensitivity around price to overcome. For those willing to be patient, sample, activate, figure out e-commerce channels, and market the occasion, solid brands will slowly rise in the ranks as the appeal to these emerging mixed sobriety occasions.

Big shoutout to 3 Tier Beverages for fueling the data behind this post. Hit them up if you’re looking to expand your visibility into market data and improve your sales analytics capabilities.