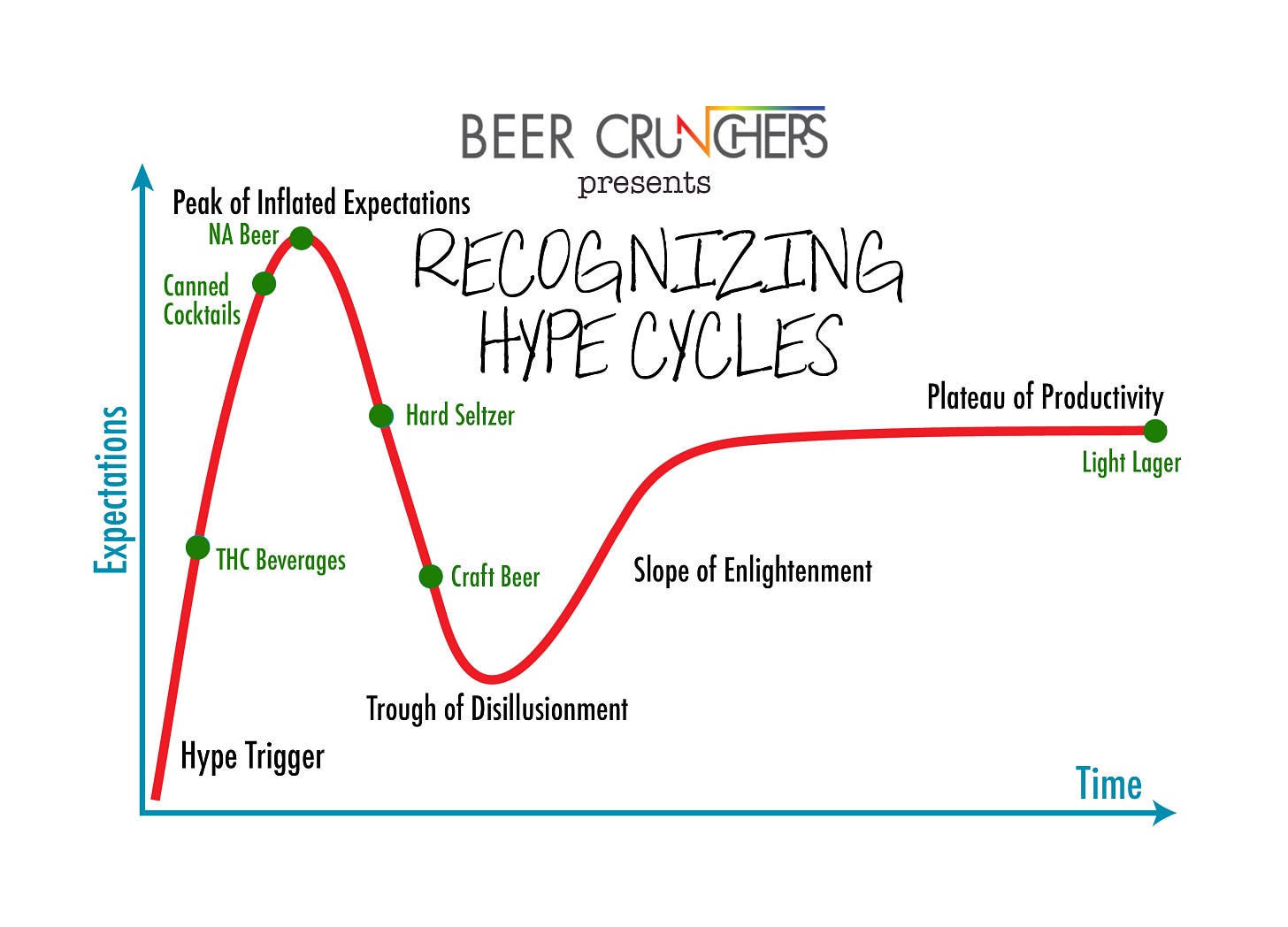

Recognizing Hype Cycles

Why are so many craft breweries are closing all of a sudden? Jaded fans are blaming style trends that go against tradition, or their own preferences. Hyperbole around “bad beer” is often cited as well, but neither are the crux of what’s actually happening. When the new wave of breweries began coming online around 2010, a hype cycle began that caused the perceived financial opportunity to inflate to illogical heights. The key to navigating these cycles successfully begins with self-awareness and an accompanying business plan that accounts for the fact that you’re in one.

The Hype Trigger

Hype is a powerful phenomenon that we’re all vulnerable to. The emotional force can be triggered by a single source, but usually coincides with macro factors that pave the way for it’s rise. It’s no coincidence that the latest craft beer boom began in the wake of the 2008 financial crash, as the economy recovered and Americans returned to a more optimistic state. Retirement savings bounced back from their 2009 lows and banks became willing to make business loans to aspiring entrepreneurs again. While the economy helped set the stage for the craft beer boom, it was the wide discovery of IPA that triggered the hype.

The full flavor, intensity, bitterness, and higher alcohol content of IPAs fueled adoption for fans of “better beer”, but it was the style’s consistent ability to stretch its definition and remain new which allowed IPA hype to reach unsustainably high levels. There was always a style evolution or new hop variety to feature, with the smartest examples built into a creative series that completists would be unable to resist. Pop-culture inspired names and artwork would prove irresistible for so many Xennials and Millennials who grew up in the 1990s chasing the 1989 Ken Griffey Jr Upper Deck Rookie Card, collecting McDonald’s souvenir cups, and watching the fever unfold from Tickle Me Elmo and Princess Diana Beanie Babies.

Hard Seltzer went through a similar hype cycle in the late 2010s, only at 4X the speed and with a fraction of the competitors. New entrants were unable to make up significant ground on the two earliest champions, White Claw & Truly, thanks in part to their national reach and the fact that “drink local” and “from the source” didn’t prove to be powerful selling stories. The trigger for Hard Seltzer’s hype was the fast-growing popularity of La Croix sparking water creating the natural evolution to a “spiked” version that’s become so common. Viral videos followed that would put Hard Seltzer onto a rocket ship, including Trevor Wallace’s comedic skit “ain’t no laws when you’re drinking claws.” This one post reached 7M views on it’s original YouTube post alone, not to mention other social mediums and reposts.

Peak of Inflated Expectations

Most agree that craft beer hype, expectations, and investment each peaked around 2015 when Lagunitas and Ballast Point were purchased at $1 Billion valuations and many large, West Coast breweries began constructing East Coast production facilities. The Hazy IPA trend followed just in time and helped prolong the peak for a couple more years. With all crazes, competitors flock to the market, production catches up to demand, and the euphoric state of the consumer cools off as the thrill of the chase, or trend, becomes a little less thrilling. Consumers didn’t stop enjoying craft beer. As time passed and keeping up became impossible, the beverage and culture just became less top of mind and slid down many consumers’ list of hobbies and interests.

Unlike Craft Beer, which definitely lost its acceleration prior to the pandemic, Hard Seltzer got caught up in the unique economic period of 2021. The country was flush with cash and record low interest rates, which led to speculative investing around anything trending, including growth technology companies, sports cards, and cryptocurrency. In beverage alcohol, Hard Seltzer was showing potential that posed a major threat to “Light Beer” and Boston Beer’s stock more than tripled in one year’s time, centered around lofty expectations for their Truly Hard Seltzer brand. The boom of 2021 didn’t last for long though as the Federal Reserve took measures to get inflation under control at the expense of the economy, including Hard Seltzer projections. Reality eventually set in and investors stopped chasing hype, turning their attention once again to actual results.

Trough of Disillusionment

Similar to the rise up the hype ladder, the path back down for a beverage trend can happen fast and be attributed to new competition, as well as broader macro factors. Both Craft Beer and Hard Seltzer are now facing offensives from non-alcoholic alternatives, spirit-based RTD cocktails, and THC-infused beverages. Simultaneously, the inflating costs of running an operation are adding pressure as they’re only partially being absorbed by the customer and at a declining volume. The brakes are being pumped on an overcooked economy, consumers are drinking less, and beer hasn’t found a compelling enough way to feel new. Of course beer is down right now.

Video Credit: @TheJarrodBenson on TikTok

It should then come as no surprise that small breweries who lack the financial flexibility to outlast a storm are being forced to close up shop. Problematic models, location and landlord struggles, weak brands, poor quality, and dependency on trends will all play a role. During the Trough of Disillusionment, a segment’s detractors smell blood and begin piling on, calling it a “fad”. Stories are picked up by media outlets with scary headlines, even casting some doubt through the minds of loyal supporters. The phenomenon reaches a bottom.

Slope of Enlightenment

While nothing can compare to the original gold rush that triggered a hype cycle, the trough can represent a fresh opportunity to invest with less exponential upside, but less risk to the downside too. At this point, any underlying issues that contributed to the decline are more apparent and able to be strategized around. A lot of noise and toxicity gets weeded out and eliminated. The fundamental core of its original success, if still relevant, can be simplified, zeroed in on, and given fresh life.

For craft beer, the slope has yet to form and may not for a bit, so what would facilitate the uptick is yet to be determined. One can imagine that less breweries is all but certain as closures and mergers pile up. Less FOMO around beer releases could reduce the rotation and one-offs a bit, leaving breweries to focus more on core principles including consistency, brand building, and loyalty. Seasonality isn’t going anywhere, but it’s possible that recurring series using flavor-of-the week premises like single hops are less a part of the industry’s future than they were a decade ago. Craft beer will need to reimagine the experience and rely less on beer itself to be the sole driver of consumption by focusing less on people who are into beer and more on people who enjoy good beer with “X”.

Plateau of Productivity

In early November, the Brewers Association’s Chief Economist Bart Watson told Masschusetts’ Guild members that the craft beer industry is no longer maturING, that it’s now fully mature. His goes on to compare the industry to a game of darts with shrinking targets, requiring more precision than ever. While he’s dead on 🎯, mature isn’t my preferred word for this confusing and chaotic state faced by craft beer and our economy. This is just my own semantics with this hype cycle narrative, but I’m personally saving the term mature for a more stable understanding of craft beer’s long term demand, where we’ve lost the breweries who can’t survive the long term without hype as a driver. I believe we’re on our way toward that point, but far from it still.

Eventually a significant and consistent enough base of drinkers will have proven that they still enjoy IPAs, Pale Ales, Wheat Beers, Craft Lagers, and beyond, surviving the swirling negativity and “uncool” connotations, ushering in an era of stability. This state of equilibrium is referred to the Plateau of Productivity according to the Gartner Hype Cycle, which I’ve borrowed from the technology world. The number of breweries and the collective output of each will find their proper sizing in each region and at each pricing tier, with less volatility and more stable churn of customers. This is the ultimate end game for this Hype Cycle in Craft Beer, but with craft breweries evolving into total beverage companies with increasing capacity, its just a matter of time until the next trigger goes off.

As a fellow CPA, I always enjoy seeing the marketing vs financial viewpoints that you offer about the industry.

Just my two cents, but from what I’ve personally witnessed from a financial perspective the three main things that are causing the closures:

Brand: You touched on this and I know you’ve harped on this before, but too many breweries set up shop, starting making beer, and never built the brand. Most craft beer fans could probably describe the mascot on the anti hero cans, or know who gumball head the cat is.

Risk Adverse Behavior: We’ve never been saturated with so much good beer, but we’ve also never had so much OK beer. With wallets tightening craft beer drinkers are being much more risk adverse (risk of drinking a crappy beer) so I’m seeing much more brand loyalty, which goes back to point #1.

Caught Up in Two Different Business Models: At the end of the day, breweries are a manufacturing business. Beer making is taking raw ingredients, and turning them into a finished product. As the craft beer industry boomed, more breweries started opening taprooms, and event spaces, and serving food (Hospitality Business). My hot take is too many breweries made a on par or subpar product and relied on the taproom to bring business in. Where instead of focusing on the product which is the manufacturing side, they tried to focus on both, because that was the trend. If you make craft beer you need to have a cool taproom. My opinion is focus on the manufacturing side and make exceptional beer, the customers will come. It also put some breweries and (still has) into this weird situation where some of their competitors on the hospitality side are also customers they are trying to sell kegs to. Also, the hospitality business is just a cut throat environment as it is. So if you aren’t making exceptional beer and barley keeping up with demand, its no surprise that so many of these places are closing.

This is purely anecdotal but I have not seen this same cycle play out too much in northern Indiana/southwestern Michigan, yet. My theory is that the cycle can be very localized and hits different areas at different times, the hype phase did not hit this area particularly hard because it came later and thus has been more smooth, and in much of the area brewery density is still very low. My gut says that rather than seeing lots of closings around here, we're more likely to see the cycle manifest in slower growth and less openings.