Tilray Brands' War Chest

Molson Coors Unloads Terrapin, Hop Valley, Revolver, and Atwater to Tilray Brands

Yesterday, I published a post that included a rare mention of Molson Coors’ craft division, Tenth & Blake. The piece was about the word “Cold” getting frequent play in new lager brands being launched, including one from AC Golden. It appears that those mentions will be even more scarce going forward. By yesterday afternoon, Molson Coors announced that AC Golden would be shut down and the other four breweries in their craft division were unloaded to cannabis-lifestyle and CPG company, Tilray Brands. I sure know how to time these things...Regardless, this transaction is fascinating from the standpoint of the craft beer M&A landscape, so let’s talk about it.

Recap

Tilray Brands made the following brewery/brand acquisitions before the start of the year:

2021: Sweetwater (GA), Green Flash (CA), Alpine (CA)

2023: Montauk (NY)

2023: Shock Top (?), Breckenridge (CO), 10 Barrel (OR), Blue Point (NY), Widmer Brothers (OR), Red Hook (WA)

In 2024, Tilray went on to start their own NA Beer brand to compete with industry leading Athletic Brewery called Runner’s High which as a dad, I thought was a clever name.

Yesterday’s purchase of Terrapin, Hop Valley, Revolver, and Atwater from Molson Coors showed that Tilray is not done. Not even close. Technically considered independent by the Brewers Association because they’re still well under 6M barrels of production and not owned by a bev-alc company who is, the additional volume should allow Tilray to easily pass Duvel (Firestone Walker/Boulevard) and Gambrinus (Shiner) to become #4 on the BA’s Top 50 Craft Brewery List in 2024.

Here’s the 2023 Production numbers:

Yuengling - 2,794,231 BBLs

Boston Beer Co - 1,4424,600 BBLs

Sierra Nevada - 1,042,256 BBLs

Gambrinus - 483,929 BBLs

Duvel - 479,821 BBLs

Tilray - 461,097 BBLs

Here’s the volume they just picked up and where it trended in 2023:

Terrapin (Athens, GA) - 80,000 BBLs (-11%)

Hop Valley (Eugene, OR) - 75,000 BBLs (-21%)

Revolver (Granbury, TX) - 28,5000 BBLs (-5%)

Atwater (Detroit, MI) - 15,000 BBLs (-3%)

Total 2023 Volume Acquired: 198,500 BBLs

Cutting Bait

For Molson Coors, there’s no growth potential looking forward for these brands as each posted negative trends in 2023. The brands aren’t dead as nearly 200,000 BBLs across four regional breweries is nothing to sneeze at, but in order to reverse these trends it would take focus, vision, energy, and dollars. As a public company focused on growing shareholder value, cutting these brands and focusing on positive trending formulas is where they’ll head instead. We saw the same of Anheuser Busch who dumped more than half of their crafty brands to Tilray in 2023 and Constellation Brands who was quickest to take the “L” in craft and move on when they cleaned house and sold off Ballast Point, Funky Buddah, and Four Corners.

There’s two ways to look at this news as I shared on social media yesterday:

Glass Half Empty Take: cRaFt iS dEaD

Glass Half Full Take: Craft Beer remains oversaturated and to win in 2024, businesses must stay culturally relevant especially in their local markets. Global brewers attempting to use craft as a pawns on a chess board is a mismatch of values between those who buy craft and those in these examples who make it.

I pre-posted this take on TikTok yesterday in hopes of giving you a comments section to dive into and as usual, TikTok did not disappoint:

Not as juicy, but in case you can’t see TikTok, here’s Instagram:

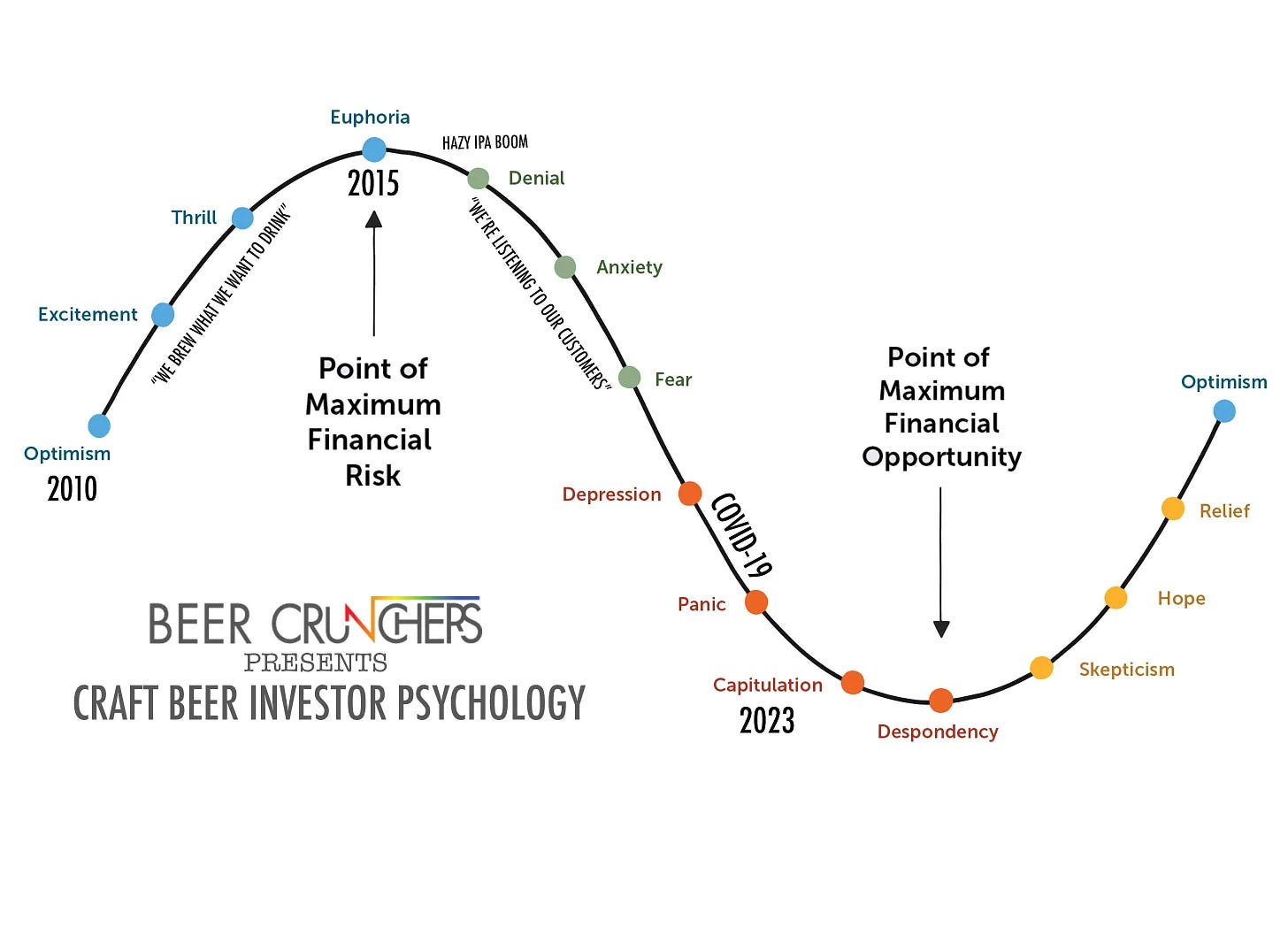

Another Man’s Treasure

Tilray has been targeting neglected brands, who once had strong followings, on the cheap. By putting a fresh coat of paint and more attention than they were getting under Molson Coors, AB-Inbev, or private equity control, they’re hoping to build back each brand’s relevance just in time to leverage the equity for cannabis beverages upon legalization. Even in this scenario where cannabis is involved, I get excited whenever I see major companies being so bullish toward beer. Their behavior aligns with my feelings that we’re in a down cycle that will transition back to recovery at some point. Aggression right now while prices are cheap has the opportunity to pay off later for those with dry powder on the sidelines.

Everyone Wins?

Not literally everyone, but most get what they want here:

Molson Coors: Offloads four businesses in one transaction that were not showing growth potential, adding focus and resources for categories that can better move the needle at their scale.

Tilray: Picks up 4 new brands, likely on the cheap, with nearly 200,000 BBLs of potential to integrate into their aggressive plans.

Employees and Fans of Acquired Breweries: Get renewed investment and energy from a fresh parent company who believes in their potential.

Independent Local Breweries: Local and independent brewers achieve another victory as a global brewer steps back from IPA production, relinquishing their attempt to use their market power to masquerade as a craft brand.

Hmmm.... I have some thoughts opinions.

Informative and well timed take (speaking to both posts). I’m curious on your thoughts to the impact legalization will have to your Craft Brewers Investor Psychology chart? Do you think having Tilray hit their stride with cannabis will elevate the craft industry back into “optimism” trajectory?