Voodoo Ranger Introducing 7.5oz "Mini Ripper" Cans 💀

New Belgium is preparing to launch 8-packs of 7.5 oz cans featuring two of its most successful, high gravity Voodoo Ranger flavors: Juice Force and Tropic Force. As the top-selling IPA brand in the country, Voodoo Ranger has seen unheard of success, yet some variations began to show signs of fatigue in 2024. This began raising the question: Have they begun to see the limit of their creative line extensions in IPA? The nation’s most aggressive crafty brewery isn’t slowing down though; instead, they’re on the hunt for fresh growth opportunities. Will these Mini Rippers serve as rocket fuel to the Voodoo Ranger lineup by opening up new drinking occasions for their boozy, 9.5% ABV juice? Let’s dive in and explore why it will work and scenarios it might not.

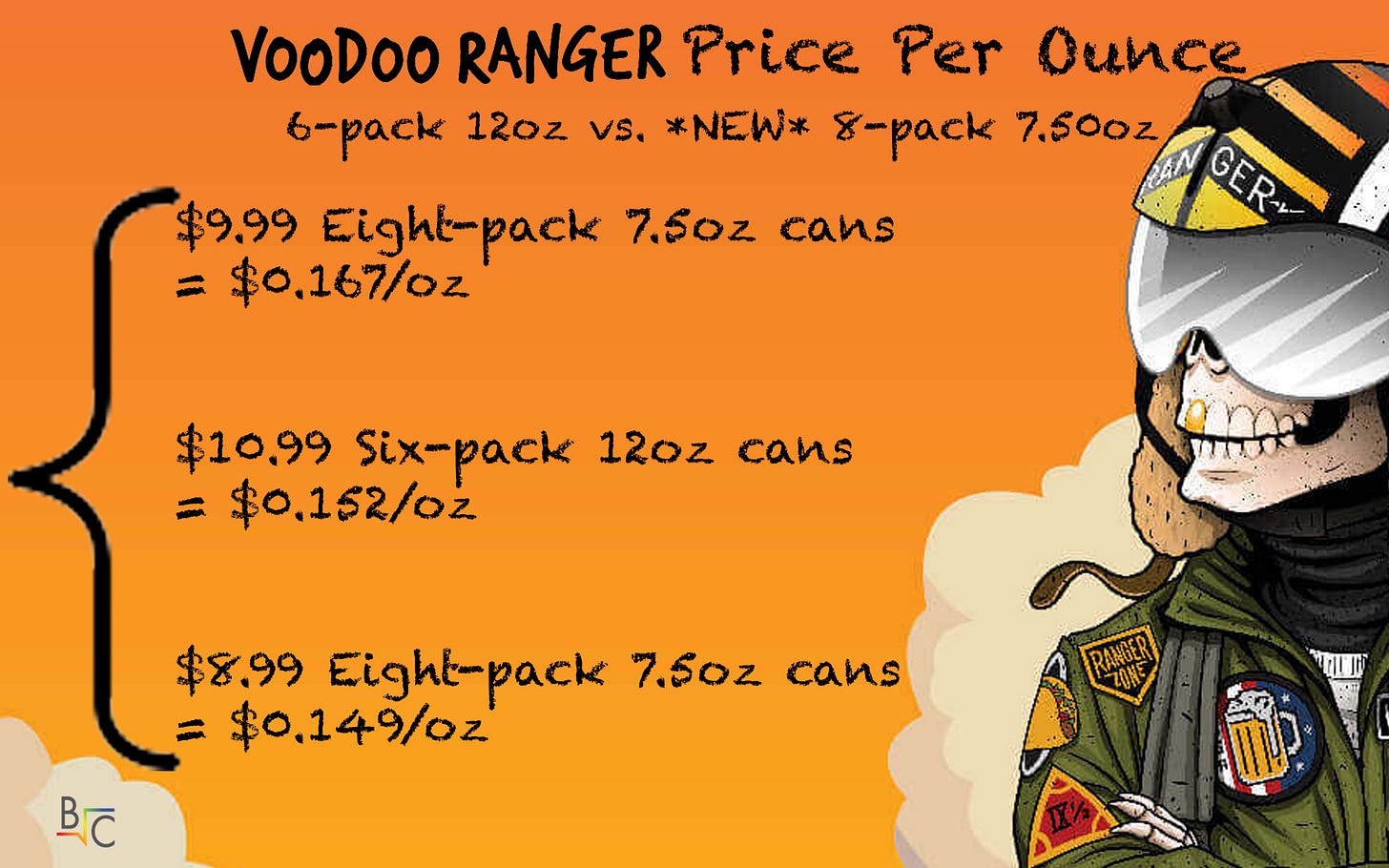

Set to arrive in March 2025, early graphic assets are boasting that the 8-packs of 7.5oz cans will be $1-2 less than 6-packs of 12oz cans. After checking my local Binny’s and Target and finding a consistent $10.99 price point for the 6-pack, that means the Mini Ripper 8-packs could retail for between $8.99 & $9.99 in my neck of the woods.

Note: These prices will vary between markets, promotional periods, and certainly be higher at smaller independent stores

If you’re anything like me, you probably look like this trying to do that cost per ounce math right now:

But don’t worry, I got you, thanks to my handy Voodoo Ranger white board.

So worst case scenario, these small serving cans will cost about 10% more per ounce than their existing 6-packs, but when they get the more aggressive $8.99 price, they’re 2% cheaper per ounce.

Here’s are my reasons to believe in this new 7.5oz size:

Competitive Advantage: Few breweries have the capability to run this size can so it’s a flex for New Belgium doing something that others in “craft” categories can’t reasonably pull off.

Novelty: Mini Rippers will almost certainly sell like hotcakes in the short term, for starters because they’re different. I could see a door in the Metaverse where these become their own modern day version of an alcoholic shot of Expresso, the ritual of an Underberg or shot of Malört, or a new version of “getting [Smirnoff] Iced”.

Moderation: On the opposite end of the spectrum, there’s drinkers who like the taste of this high ABV juice, but want a version with the ABV impact of a more typical beer. 10% ABV but 37% less of it compared to the 12oz provides the same buzz of a 12oz can of a 6% IPA.

More Portions: If the price is close enough to the 12oz, some individuals or groups will buy them because they receive the same amount of beer for their money, but broken up across more portions. This opens up more occasions for sharing, including in the novelty forms mentioned above.

Storage, Portability, Convenience: Small and easy to pack up and take on the go.

Fun: They’re pretty dang fun too, I gotta say 😎

Here are my possible reasons to doubt Mini Rippers beyond the short term:

The 7.5oz cans shouldn’t have any trouble moving, but the question is whether they’ll bring in new drinkers and more volume overall to the VR family. There’s a very reasonable scenario where, especially once the newness wears off, that these are simply a trade between the 6-pack 12oz volume.

The $1 off price leads to a 10% increase in cost/ounce to the consumer. I believe their consumers will pay for that in the short term, due to the novelty and confusing math to even realize it. But long term, the price may need to be more consistently at that $2 off level for these to move incrementally and there’s a scenario again where that’s only happening at the expense of the 6-pack.

For New Belgium, this is a super smart way to use the market leverage of Voodoo Ranger to continue asking for more shelf space, without creating another unnecessary flavor. Some refer to this strategy as a “Blocker SKU” where given the success of Voodoo Ranger, stores are not going to say no to this new “innovation”. Regardless of it’s success in the medium to long term, Mini Rippers will use it’s elbows to block a spot on the shelf from less compelling competitor beginning this Spring.