In a game of Limbo, the stick starts high, with most entrants able to get off to a successful start, with plenty of room to work and easy wins to get started. After each round however, the stick lowers and the degree of difficulty is raised. Those with flexibility are long for the game, whereas those unable to adapt end up on their backs.

Nostradouglas, Doug’s soothsaying alter ego, is back to share four fascinating trends in the beverage alcohol space that each uniquely fit today’s theme, “How Low Can You Go?”. While some of today’s topics may come and go, others signal a more fundamental change in consumer behavior, each hinting at a recalibration of what we value in our drinks.

1. Low Alcohol 🔎

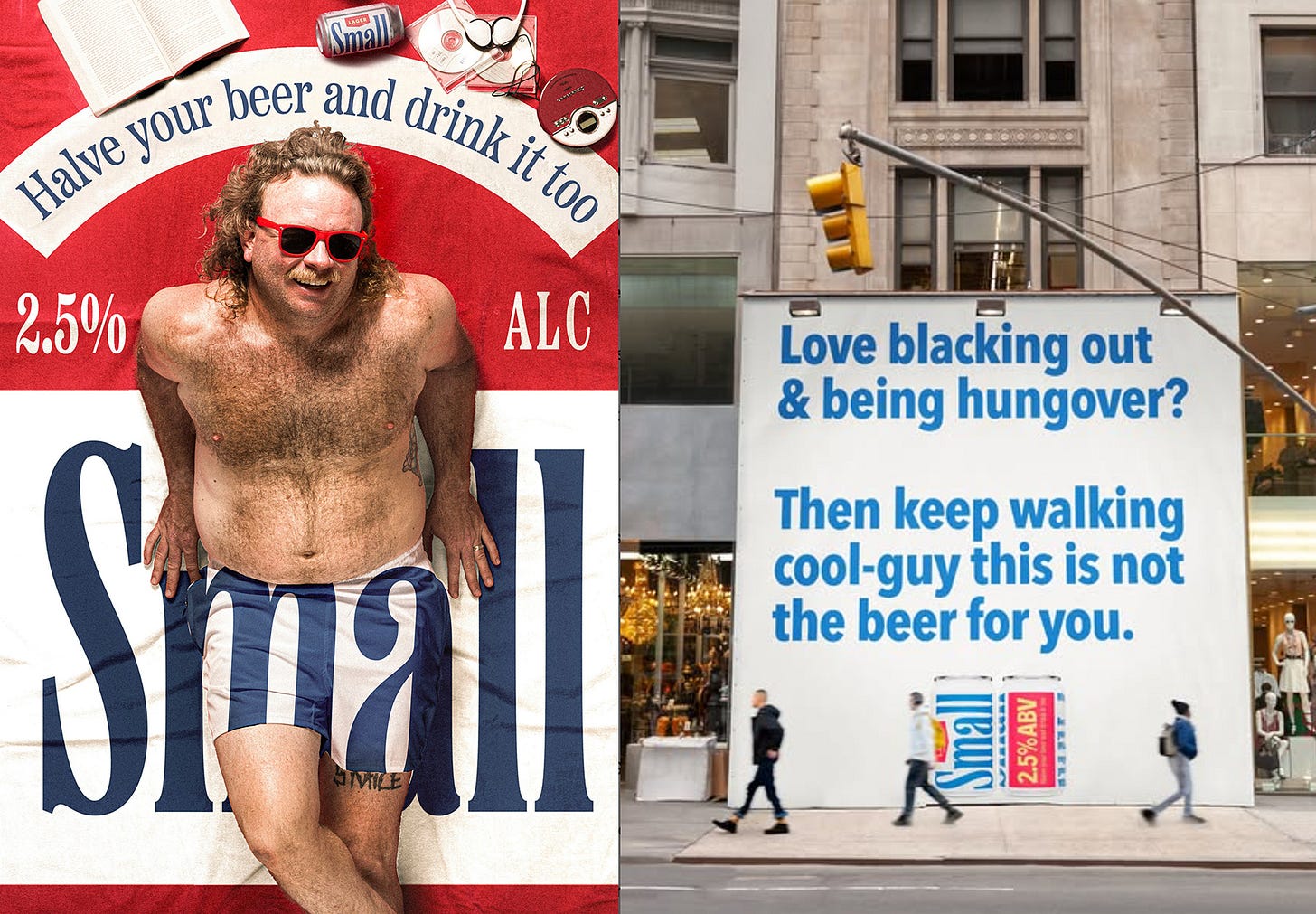

A couple new beer brands have recently launched that aim to create a middle ground between non-alcoholic and traditional beer, both targeting the hangover, alongside other occasions and selling points.

Small Beer is a 2.5% ABV, 80 calorie Lager “for people with sh*t to do tomorrow”. “Small lets you halve your beer and drink it too. So you can enjoy today, and tomorrow.” Their marketing leans fun, with intentionally outrageous lifestyle shots, mixing in some 90’s nostalgia surrounding their front man who resembles a more stylin’ Erlich Bachman from the HBO show Silicon Valley.

Their Instagram page utilizes memes and billboard mock-ups that cover a variety of different messages, including attacks on the days of blacking out, and the feeling the next day. If you’re still not sold on 2.5% beer, they offer 15 reasons on their website, further blending serious takes with comic relief:

Because the last time you drank big beers you had to leave the family minivan at Top Golf.

Because everything in moderation.

Because yard-work, fishing, family reunions, day-drinking, festivals, and the ability to maintain your buzz without going over the edge.

Because you can drink a 6-pack of these and still carry on a conversation.

Because your toddler is getting up at 5:35am on the dot whether you're hungover or not.

Because you're going to have to see your co-workers again.

Because you actually have a pretty nice little Saturday planned.

Because now “streaking through the quad” will get you in very, very serious trouble.

Because your in-laws are going to bring up politics and this time you need to be cordial.

Because just the thought of drinking 9% beer gives you a hangover.

Because you know damn well you have no business getting “wrecked” or going to a “rager”.

Because golfing, skiing, and watching your kids is more fun with a reasonable amount of beer.

Because you're the reason they stopped selling booze at the Waste Management.

Because you care about your health and the amount of carbs and calories in your beer.

And lastly, because proving to everyone how much alcohol you can drink is still super cool, right?

The brand is just getting started with limited distribution, mostly around Denver, Colorado Springs, and more recently Austin, TX.

Dad Strength Brewing is going after the same occasions, but with notable differences including a little less vibe, and lot more behind-the-scenes. They started with an IPA and an Apricot IPA, at 2.9% and 2.8% ABV respectively, each claiming 94 calories on the can. “Brewed for a better tomorrow” at “half the alcohol of a regular IPA and fewer calories than a light beer” because “6, 7, 8% is too high and 0% is too low.”

Dad Strength’s messaging and social media has a little more serious tone, with occasional stories like their co-founder lying to his doctor about how much he was drinking, but remains casual and dad-like in many ways. The founders are the stars of their own social media and take you to samplings with examples of successful interactions with newly acquired customers. Their distribution includes Trader Joe's, Whole Foods, and 200+ locations in Washington, DC + Montgomery County area according to their website.

Nostradouglas has been a noted skeptic of the mid-strength beer concept dating back a few years:

This was not intended to dismiss the category, but more so a jab at the amount of work and focus this segment would take to build in the US. There’s no doubt interested customers and potential for well-funded brands to figure it out. If I were a potential investor, the concerns that I would want to hear addressed would include:

Consumer Education Gap: The category doesn’t really exist, so there’s a ton of groundwork that needs to be done to introduce consumers, distributors, and retailers to the concept, not just the brand. A brand can certainly be built with viral content on social media, but the longest lasting victories will need to be won in the trenches, sampling customers face-to-face, one-by-one, with boots on the ground wherever the product can be purchased.

Budget Hurdles: Heineken and Athletic Brewing have been successfully building the Non-Alcoholic segment in the US this way, just swap viral with paid (and earned) media. Hundreds of millions of dollars have been deployed in the last five years to promote the category and lifestyle from these two brands alone, just to get it pushing toward 2% of total beer sales. Big checks are being written, because that’s what it taken for NA to break through.

Value Proposition: Unfortunately a 2.5% beer does not cost half as much as a 5.0% beer to make, all-in. Due to the costs of packaging, production, and the distributor & retailer margins, any difference in recipe cost will not lead to material room to differentiate the price to the consumer. You are solely relying on consumers who will pay essentially the same price, for less alcohol. Similar to 8oz Coke cans which often cost no less than 12oz, there IS a customer. The question is, how many are there and what’s the cost to acquire each?

As a busy father of two busy kids, these days I like the taste and ritual of beers with friends a lot more than I care about the alcohol side of it. I am the target audience for Small Beer and Dad Strength if the taste and flavor are there, so I am rooting for both, and others, to make mid-strength beer happen. The degree of difficulty and investment is sky high because they aren’t just building brands, they’re building an entire category that needs a lot of education and inherently asks the consumer to pay more or the same, for less (alcohol).

2. Low Volume 🔎

Speaking of small can sizes, this niche has been probed at for decades by the beer industry. Rolling Rock, Modelitos, and the classic Miller High Life pony bottles have served as great final-final, side car, and cocktail-adjacent tools in the on-premise especially. On the craft beer side, Chicago’s Hopewell has championed their own equivalent with Lil’ Buddy, a cute German-style Helles Lager in stubby 8oz cans, which just raised their game in early 2025 by launching 8-pack cartons compared to their original paktech 4-packs.

The red hot canned cocktail market has found their way into small formats as well. With lower volume being the standard for high-end concoctions, the logic is quite sound, and has a way of making them feel more premium than say a High Noon and Cutwater which are built for volume. My personal favorite brand that I’ve come across who is elevating the experience is Tip Top Proper Cocktails which have a thoughtful, but simple and straight-forward aesthetic surrounding their 100ml cans. As a side note, I love their commitment to always showing the beverage poured into a glass, with a proper garnish.

Well before Tip Top was elevating the “proper” cocktail occasion, Buzzballz was laying the groundwork. Beginning in 2009, their focus was on younger demographics looking for approachable, flavorful cocktails that don’t require drinking as much volume to get a buzz on. The unique, round format was inspired by party balls, adding addition intrigue, and packing a hefty 13.5% ABV into 200ml plastic serving sizes. Ever since being acquired by Sazerac last Spring, the rest of the alcohol industry has been on the prowl, in search of their own method of packing a big punch into small novel packaging.

After seeing diminishing returns from the last few rounds of new flavors in their industry-leading Voodoo Ranger series, New Belgium was a prime candidate to explore these alternative formats to further fortify their dominance on the shelf. Going in the opposite direction as their popular 19.2oz Single Serve cans, slick little 7.5oz Mini Rippers started rolling off the canning line last week, in 8-packs.

New Belgium’s answer to Buzzballz weigh in at 9.5% ABV, with top-selling brands Juice Force and Tropic Force aiming to instigate new occasions for Voodoo Ranger fans. As their CEO Shaun Belongie told BeerNet Radio, “Hey, there’s five minutes until your Uber gets to your house. What am I going to have? It’s a Mini Ripper.”

Other malt-derived beverages are getting in on this buzzballzy strategy of packing a lot of ABV and natural flavors into a small package. Smirnoff began pushing the limits with its single-serve 6.75oz Shorties at 13% ABV, nearly triple the strength of their traditional Smirnoff Ice 6-packs which clock in 11.2oz at 4.5% ABV. These are great for gaining new, out of department positioning, especially right at the register of convenience stores for a last second, impulsive addition.

Think consumers don’t care? My Instagram post on this is still cranking through the Reels gauntlet months later with 430,000+ views and a eerily similar 408,000 views on TikTok 😳 One of the most popular complaints is from young consumers complaining of “shrikflation”. Despite the fact that the original format still exists at the same old price and that the price/ounce is actually quite reasonable, there is a natural distrust from young, inflation-defeated consumers that I see bear out in these viral posts. Scan through the comments in either post to get a taste 👆

Now, I know what you’re thinking, “but Nostradouglas, aren’t these just Mad Dog 20/20s?” No, but these are:

Nostradouglas expects to see a considerable number of small formats launching this year and next across all of bev-alc + D9 THC, but doesn’t see any Gold Rush moment for craft brewers here. Occasional thoughtful brands like Lil’ Buddy are really fun, standout, and can serve as a strong supporting role in a portfolio as long as everyone and their mother isn’t trying to do the same thing.

The most interesting opportunity for craft in 8oz cans is likely with big stouts like an Oskar Blues Ten Fidy and of course barrel-aged strong beer. These are not volume drivers and have minimal upside, but Nostradouglas sees few notable examples being introduced this fall.

3. Low Price 🔮

Last year, Nostradouglas anticipated that more craft breweries would begin offering a 12oz size of an especially drinkable style like lager, kölsch, or golden ale at their Taproom. The strategy would be to feature one of these pours on permanent special at an especially low cost of entry by craft standards, say $5. The 12oz size helps keep the price/ounce from undercutting the market too much, while also leading to a greater chance that they stay for a 2nd or 3rd.

In 2025, Nostradouglas will be doubling down by expanding on this prediction, no longer limiting it to smaller glass sizes. Breweries will begin getting creative with ways to offer customers an affordable entry point that slowly chips away at the perception that craft beer is way too expensive. With inflation threatening to worsen, offering an attractive price could build a deeper roster of regulars from the neighborhood while also changing the minds of first-time guests, especially those who are only there because it's a friend’s birthday.

Chicago’s Dovetail Brewery, who I mention quite a bit for their creative Taproom strategies, is going about this in an interesting way. They’re rotating between their 4 flagship beers each quarter, always offering one as a $4 half-liter pour and $8.99/4-pack of tallboys to-go. The challenge with going low at your own location is that it can impact retailers who make no margin going that low and consider you to be undercutting them when you’re supposed to be their partner.

In Dovetail’s case, with each Core $ Four being year-round and regularly changing up the featured brand, the promotion can be considered a net positive by using it as a springboard to gaining trials and building a deeper appreciation for the entire roster. The calendar approach also gives them a specific defined window of the year to focus a little harder on messaging for each and re-communicate the key selling points, flavors, and ideal pairings.

4. Low Finishing Gravity 🔮

As the Hazy IPA finds itself entering a more mature status, new riffs on the style are happening at a less frequent clip that we were accustomed to seeing 4-6 years ago. Rather than pushing more future innovation and exploration to an audience that’s beginning to flatten out, Nostradouglas see more modern-leaning breweries diverting a portion of their enthusiasm to the world of dry beer. This avenue will not be instead of Hazy IPAs that built many of these contemporary breweries, far from it, but instead serve as complementary assortment, or even hedge, as these breweries feel the need to branch out, diversify, and be true to their own evolving palates.

The City of Chicago’s most energetic and IPA-forward brewery is Hop Butcher for the World. They’re known for always being on the cutting edge of exciting new hop varieties, while pushing the sweeter side of the spectrum more often than not. Case in point, they held an event to close out January called Dry Day, featuring an assortment of 6 beers that showcased new and innovative releases from small local breweries, along with classic dry beers from global powerhouses like Sapporo and Asahi Super Dry. To their fans who know the brewery much more so for the opposite, seeing their favorite brewery champion something new is going to slow change consumers openness to the other side of the spectrum.

Taking The Low Ground

Strategies in the beverage-alcohol industry often involve going high, like 19.2oz single serve cans, big ABV, premium pricing, or even THC (eh?). A number of 2025's newest trends, however, involve going low. Whether its a problem looking for a solution, or a solution looking for a problem, innovation is staying flexible as it explores potentially available white space beneath the limbo stick. Low ABV, low volume, low price, and low finishing gravity are taking aim at moderation, volume intake, value, and palate burnout. Are these future fads, or rather indicative of cultural shifts playing out across very different consumer segments? The beverage-alcohol industry has no “shortage” of players looking to test all theories around how low they can go.

This is a great post.

I’m your age group as well with kids to truck around and a to do list. Low ABV definitely would appeal to me - if they tasted great and there was a variety of styles. Sometimes I feel like in the new format, N/A, seltzer, kaboucha, tea, THC discussion the importance of superior taste gets lost. If there is an ability of a brewer to differentiate themselves and their brand around superior taste, the consumer will follow.

The British I believe have a history of low ABV milds and porters? Seems like there is definite precedent.